Top 8 Equity Linked Saving Scheme or ELSS funds – one of the top choices to save tax and do investment at the same time

Hi, I hope you are doing well. Thank you so much for stopping by. It’s another day to learn something fruitful. To give you an idea of what we will be learning here. The guide will help you understand Equity Linked Saving Scheme or commonly known as ELSS funds. This fund is one of the best ways to save tax in India. We are going to see the top 8 ELSS funds, where you can invest to get good returns and save tax under income tax section 80C.

What is an ELSS fund?

ELSS stands for Equity Linked Saving Scheme. It is the only type of Mutual Fund using which you can save income tax under section 80C of the Income Tax Act, 1961. An ELSS fund has a lock-in period of 3 years, which means if you invest in an ELSS fund you can break that mutual fund partially or fully only after 3 years from the date of investment. That said, a very important thing to note is, ELSS has the shortest lock-in period among all the schemes and tools that are available to save tax under section 80C.

As the name goes Equity Linked Saving Scheme (ELSS), the major portion of the fund is invested in the stock market or Equity and a small portion might get invested in fixed-income securities. These funds primarily invest in stocks of listed companies in a specific proportion according to the investment objective of the fund. The stocks are chosen from across market capitalization (Large Caps, Mid Caps, Small Caps) and industry sectors.

How do you save tax by investing in an ELSS fund?

Investing in an ELSS mutual fund doesn’t have any upper limits, you can invest whatever amount you want. The scheme or the fund helps you save tax by deducting up to Rs 1.5 lakh from your taxable income. That is you can save up to 46,800.

Remember that, if you are invested in any of the section 80C investment options, in order to available the deduction and save tax you need to file your ITR using old tax regimes i.e tax rate

For example, let’s assume your taxable income is 10,00,000 for the financial year 2022-2023 i.e ( from 1st April 2022 to 31st March 2023). For this, you will file your tax in the fiscal year 2023-2024.

So as per your above taxable income and considering the old tax regime, you will end up paying approximately 1,12,500 rupees as Income Tax.

Now let’s consider you have invested 1,50,000 rupees in the ELSS mutual fund in FY 2022-2023. With that, your taxable income reduces to 8,50,000 (10,00,000-1,50,000).

Considering the above new taxable income and the old tax regime you will now pay approximately 82,500 rupees as Income Tax. Thus saving approximately 30,000 thousand rupees.

Above saving increase in the case where once switches its tax bracket after deducting ELSS investment of 1.5 Lakh. For example, if one was in tax slab 30% and after deducting 1.5 L from its table income now the person is in 20% tax slab.

Is ELSS taxable after 3 years?

Many of you have the above concerns, even I had it when I was investing in an ELSS mutual fund to save tax. Many of us make the same mistake and that is we just look for the above question followed by searching for the word “Yes” or “No”. We end up making up our minds without even reading the entire sentence or understanding why “Yes” or “No”. So read and understand the below para carefully.

The amount invested in an ELSS mutual fund is not taxable after breaking the ELSS. The returns generated from the amount invested in the ELSS mutual fund are taxable. Now, since ELSS has a minimum of 3 years of lock-in you will end up breaking ELSS only after 3 years. Due to this your return will fall into long-term capital gain. Another thing to note is the Long Term Capital Gains from ELSS are tax-free up to a limit of ₹1 lac. Gains over 1 lac attract a tax rate of just 10%. Lower tax rates, coupled with higher returns ensure the best post-tax returns.

For example, if you have invested 1.5L in ELSS mutual fund and over the period of 3 years you got 40% return. So, you got a 60,000 rupee return. In this case, you need to pay 0% tax. As up to 1L return is not taxable.

(Note: the returns are not guaranteed since the investment is an equity nature).

Let’s look at the top 8 ELSS mutual funds as per my understanding and analysis.

Please do your research before investing in any Mutual fund or stocks. Don’t just blindly follow things if someone is saying them. You can use someone’s suggestion to optimize and ease your search process.

Top 8 ELSS mutual funds

1. Quant Tax Plan Direct-Growth

3Y annualized return = 40.12%

5Y annualized return = 22.77%

Fund Size = 2327.41cr

Rating = 5

Top 10 holding out of a total of 50 holdings:

Fund’s equity sector investment is:

2. Canara Robeco Equity Tax Saver Direct Growth

3Y annualized return = 20.97%

5Y annualized return = 15.70%

Fund Size = 4582.95cr

Rating = 5

Top 10 holding out of a total of 57 holdings:

Fund’s equity sector investment is:

3. Parag Parikh Tax Saver Fund Direct-Growth

3Y annualized return = 23.96%

5Y annualized return = Not Applicable

Fund Size = 900.86cr

Rating = 5

Top 10 holding out of a total of 30 holdings:

Fund’s equity sector investment is:

4. Mirae Asset Tax Saver Fund Direct-Growth

3Y annualized return = 19.57%

5Y annualized return = 14.61%

Fund Size = 14,255.39cr

Rating = 5

Top 10 holding out of a total of 69 holdings:

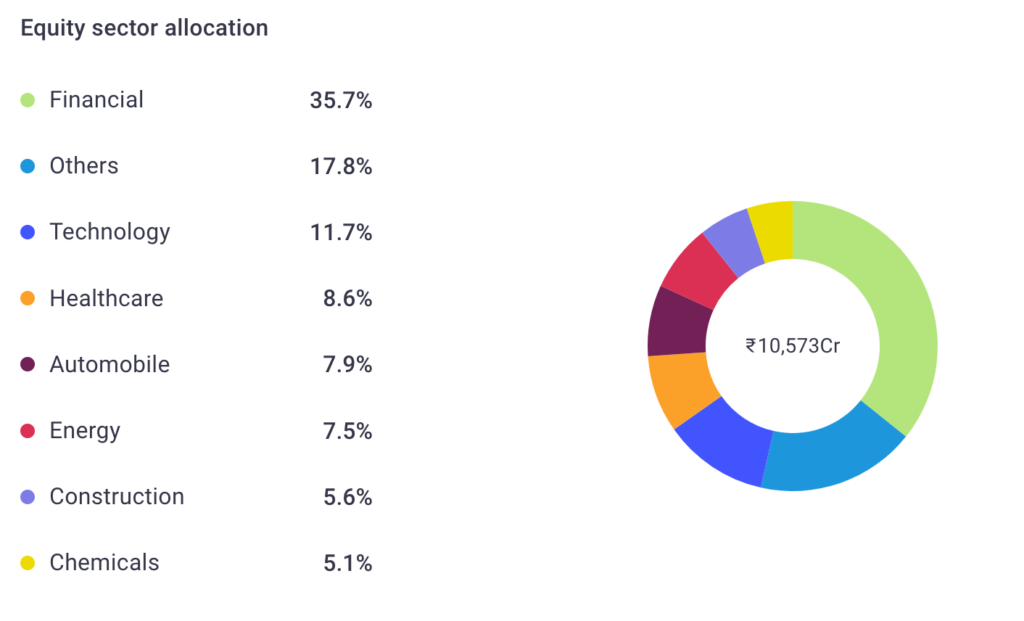

Fund’s equity sector investment is:

5. IDFC Tax Advantage (ELSS) Direct Plan-Growth

3Y annualized return = 23.82%

5Y annualized return = 12.59%

Fund Size = 14,255.39cr

Rating = 4

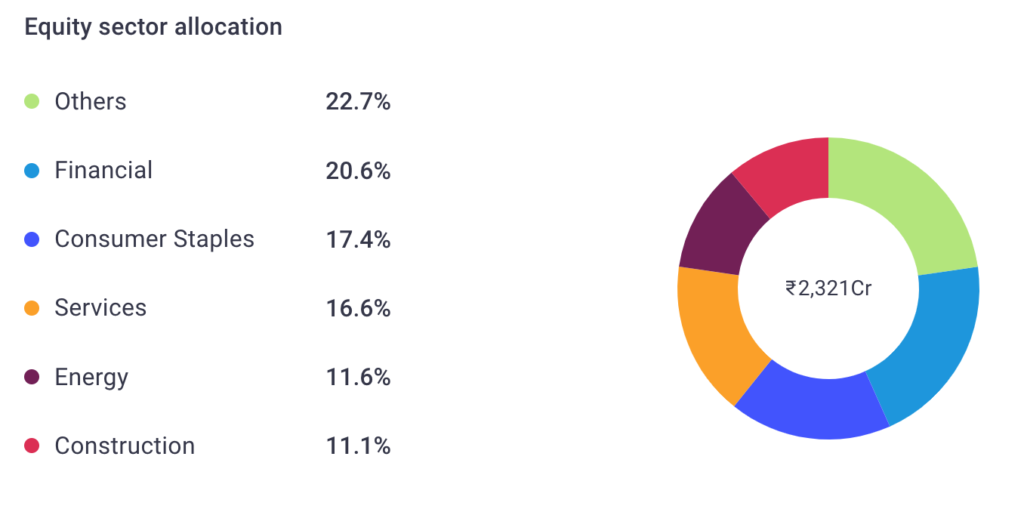

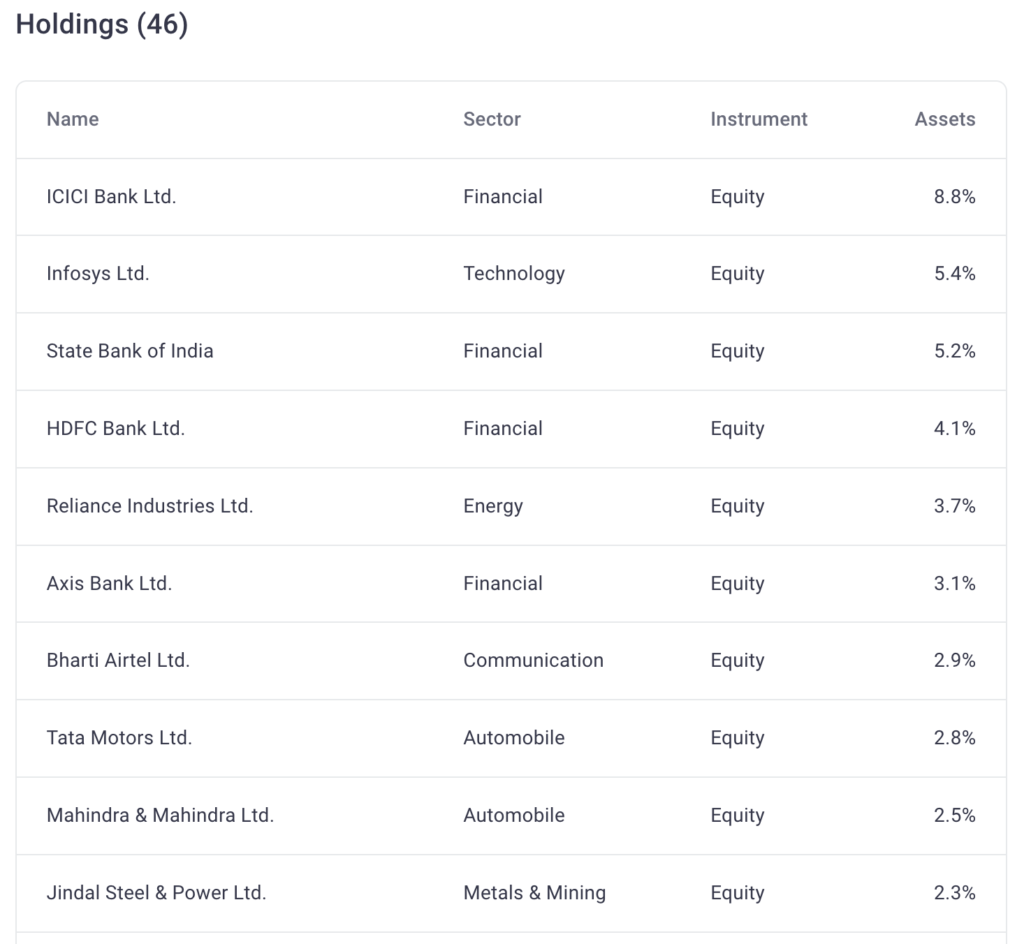

Top 10 holding out of a total of 46 holdings:

Fund’s equity sector investment is:

6. Bank of India Tax Advantage Direct-Growth

3Y annualized return = 23.35%

5Y annualized return = 13.34%

Fund Size = 696.93cr

Rating = 4

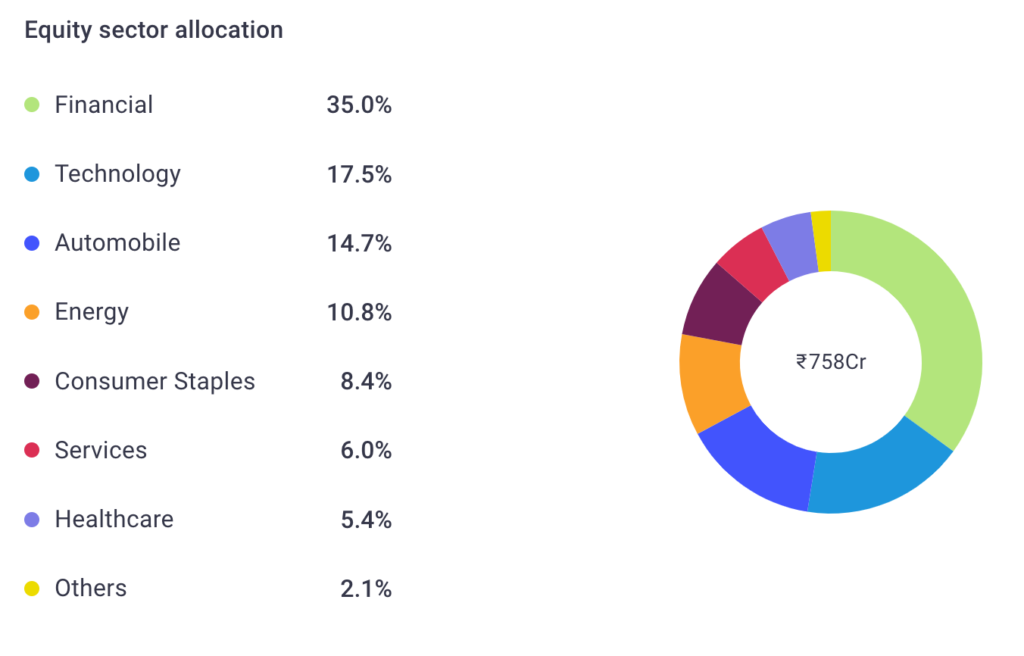

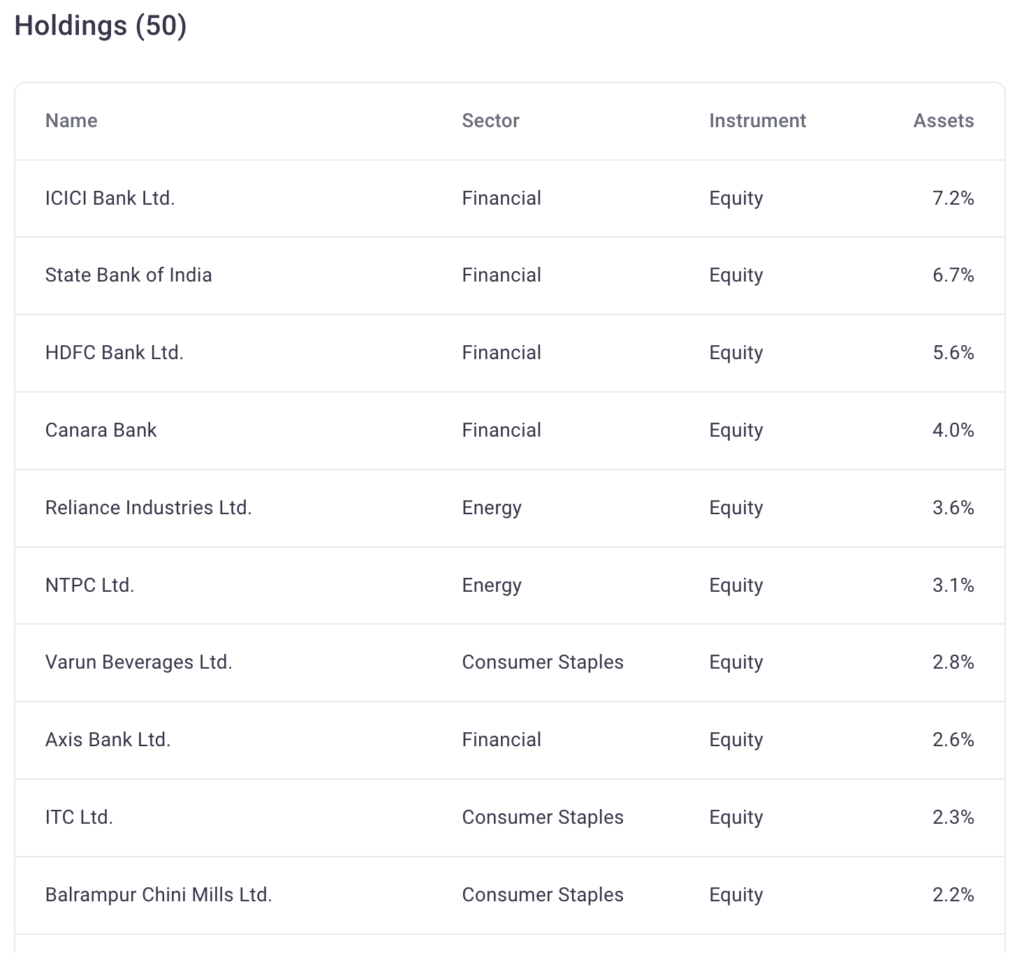

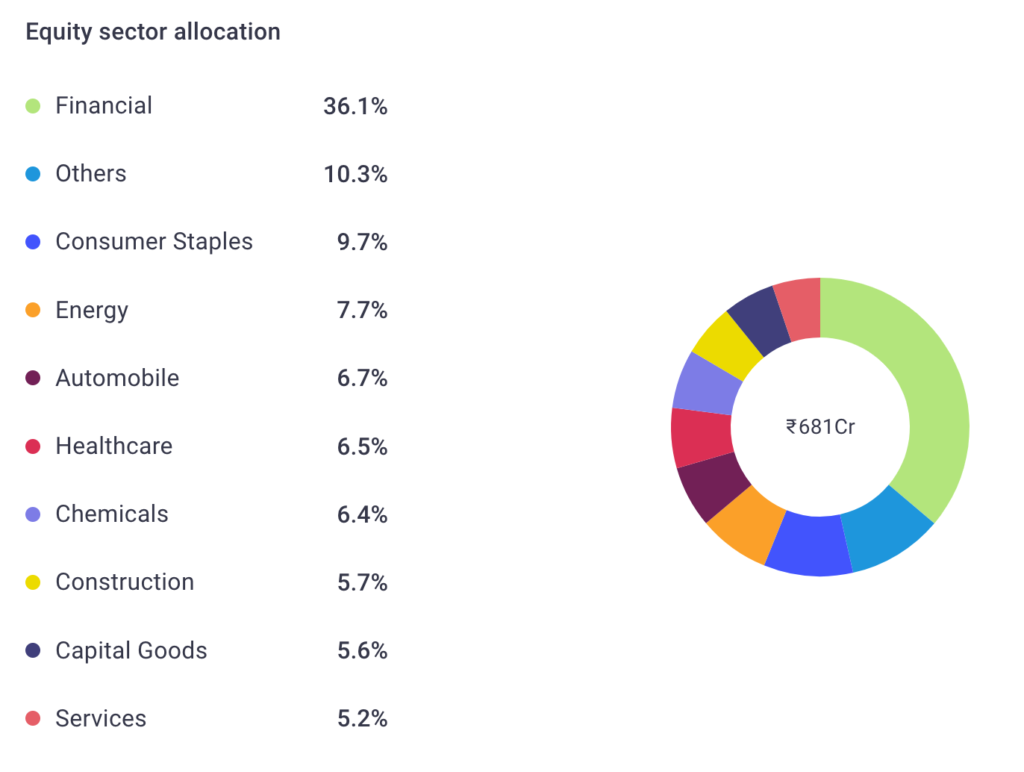

Top 10 holding out of a total of 50 holdings:

Fund’s equity sector investment is:

7. PGIM India ELSS Tax Saver Fund Direct-Growth

3Y annualized return = 20.69%

5Y annualized return = 13.21%

Fund Size = 453.51cr

Rating = 4

Top 10 holding out of a total of 36 holdings:

Fund’s equity sector investment is:

8. DSP Tax Saver Direct Plan-Growth

3Y annualized return = 18.47%

5Y annualized return = 12.55%

Fund Size = 10,715.09cr

Rating = 4

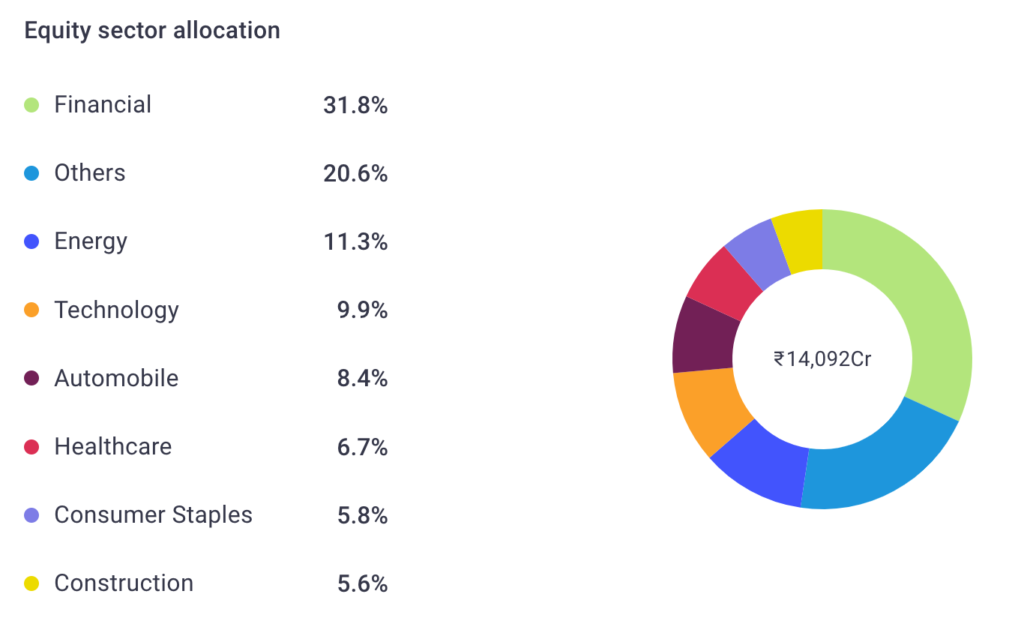

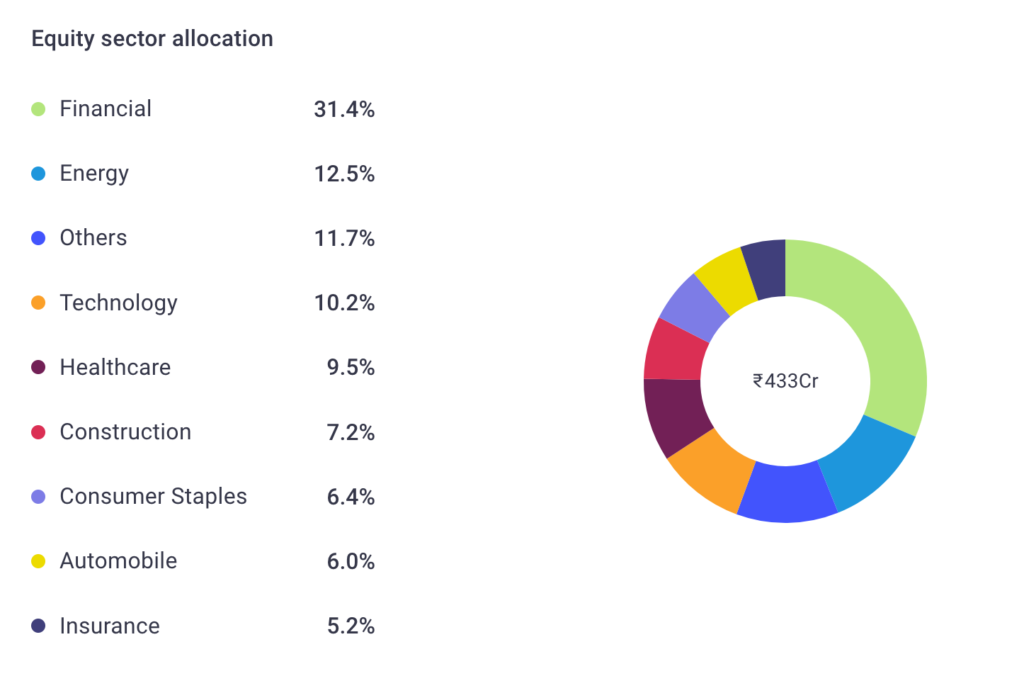

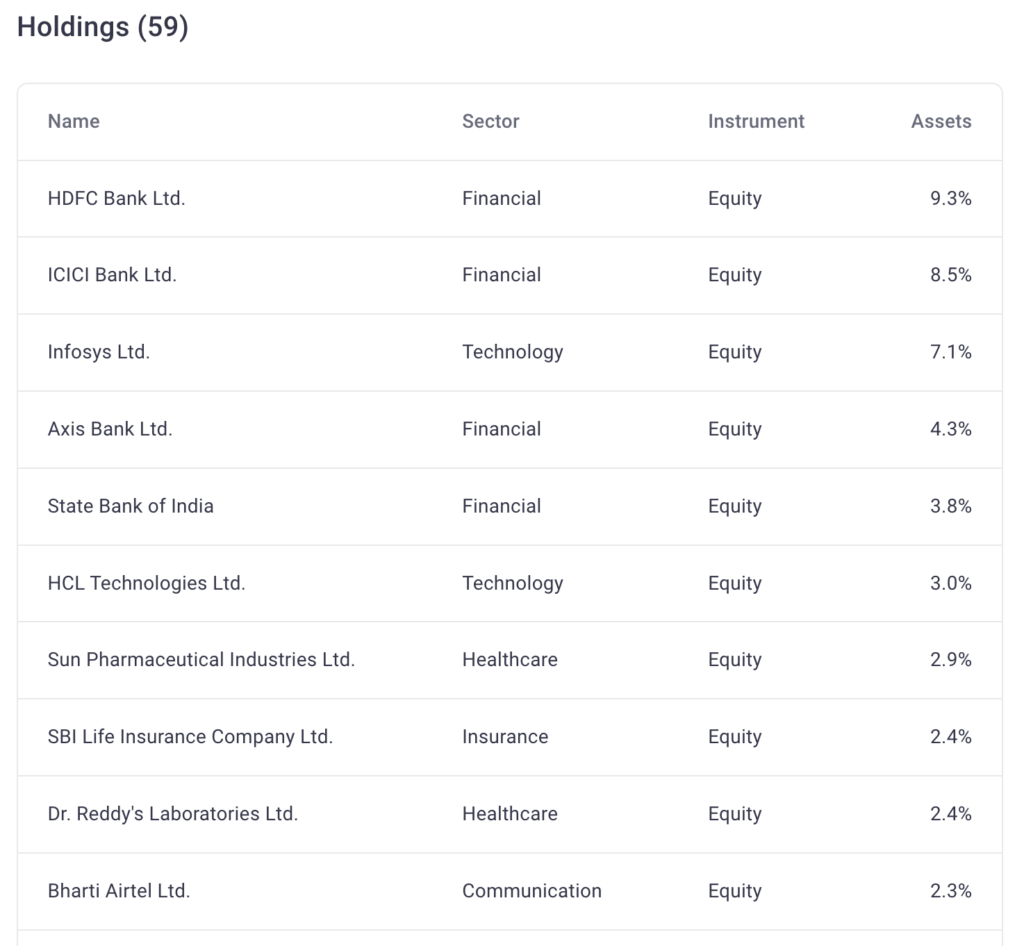

Top 10 holding out of a total of 59 holdings:

Fund’s equity sector investment is:

Hope I was able to give you worth full information and guidance. I wish you to end by investing in the above ELSS funds or any other investment options. I believe for financial stability and independence one needs to start a careful investment as soon as possible.

If this guide was able to help you in any way, support me by sharing it with your friends and connection. Thank you! see you soon.

If you have any questions or comments feel free to reach me at ->

Checkout out my other Social Category